does unemployment reduce tax refund

To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000. The IRS is sending nearly 4 million more refunds to people who overpaid taxes on unemployment benefits before the passage of the 19 trillion American Rescue Plan the.

Tax Form Arriving Soon For Unemployment Program Claimants Lower Bucks Times

A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

. While it may be. This threshold applies to all filing statuses and it doesnt double to. COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable.

ANCHOR payments will be paid in the form of a direct deposit or check not as credits to property tax bills. Dont expect a refund for unemployment benefits. The amount of the refund will vary per person depending on overall.

A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. Scenarios like this are where GAR Disability Advocates can help workers receive the benefits they are entitled to. How does unemployment affect your tax refund.

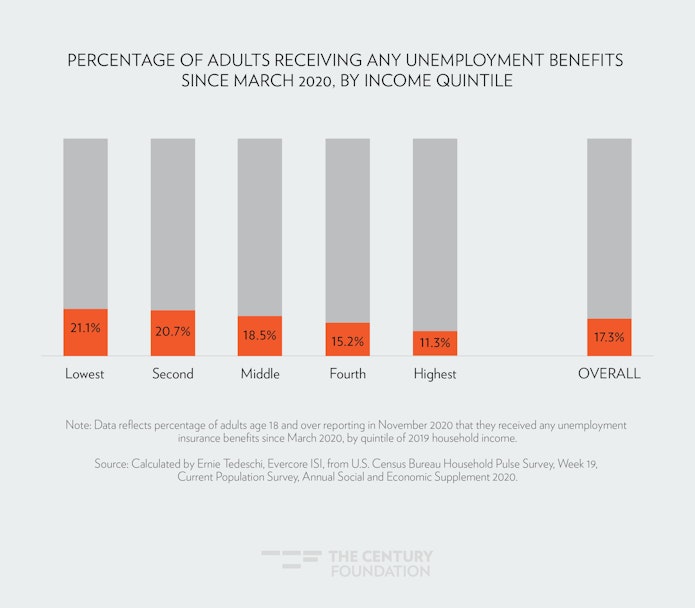

Most states do not withhold taxes from unemployment benefits voluntarily but you can request they withhold taxes. Another 15 million taxpayers will receive their unemployment tax refunds as the IRS continues to adjust returns based on a provision of the 19 trillion American Rescue. Refund of State Unemployment Tax.

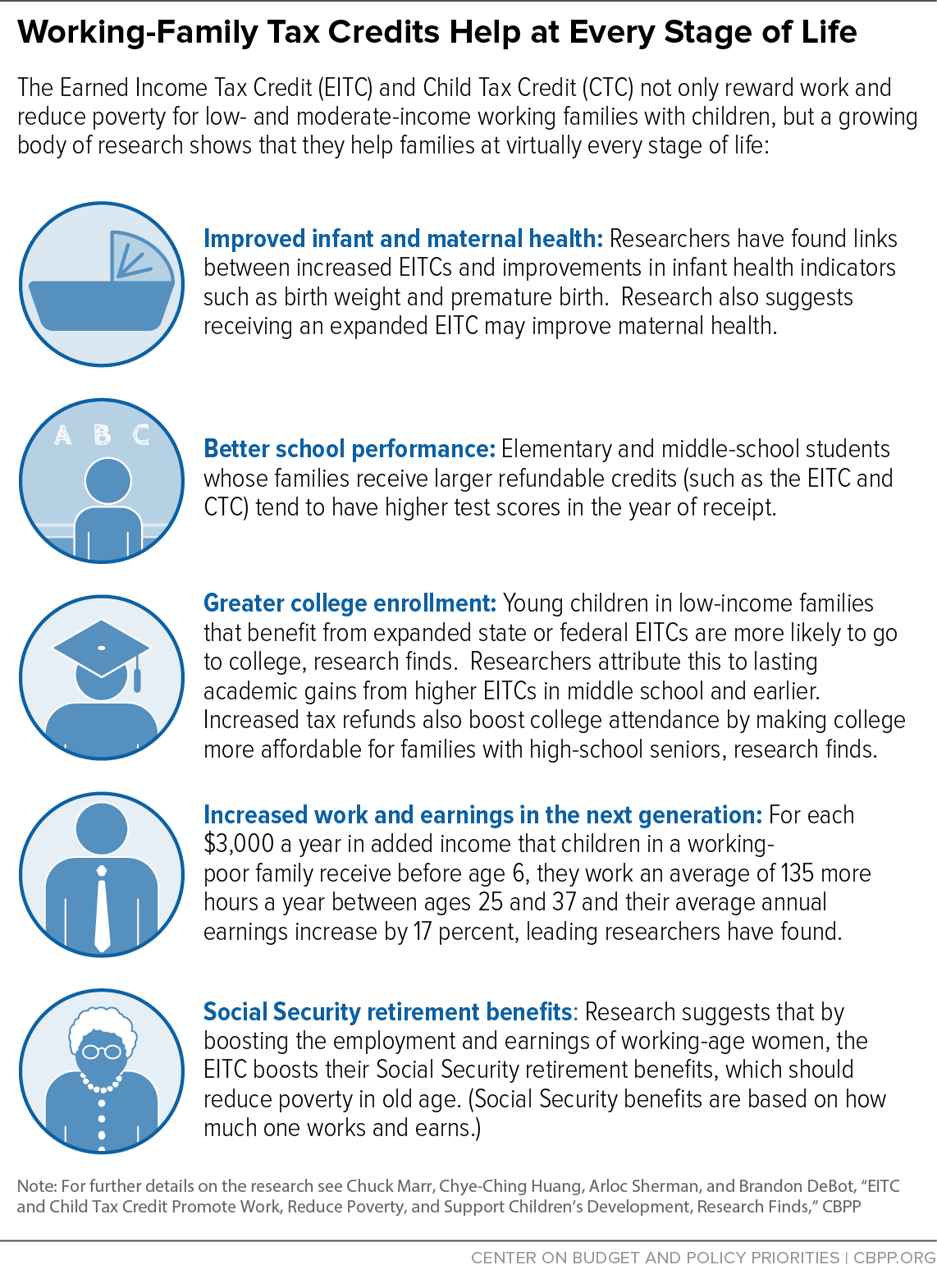

But for many jobless workers and their families those payments come with a catch. At least 7 million people likely qualify for tax refunds on unemployment benefits received last year a new report suggests. They may result in smaller refunds from tax credits such as the earned income tax.

As a result of changes introduced by the American Rescue Plan Americans who have received unemployment compensation no longer have to pay income taxes on the first. If youve paid too much during the year youll get. Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962.

3 3The IRS Just Sent More. The federal tax code counts jobless. The IRS said it will automate refunds for unemployed people who have already filed their tax returns because of a provision in the 19 trillion coronavirus relief bill.

IR-2021-71 March 31 2021 WASHINGTON To help taxpayers the Internal Revenue Service announced today that it. Well yes the unemployment benefits are taxable. Married couples who file jointly and where both spouses were.

Samuel CorumBloomberg via Getty Images. Tax season started Jan. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund.

While getting a big tax refund can feel like an exciting windfall the IRS doesnt want you to count on that money too soon. Unfortunately thats no longer true. You will need your social.

In response to the COVID-19 pandemic my state has issued a refund of first quarter 2020 state unemployment taxes. Dont bank everything on an incoming refund. Long ago unemployment benefits were exempt from income tax.

Unemployment tax refund question. If you are receiving unemployment benefits check with your state about. Youre eligible for the tax refund if your household earned less than 150000 regardless of filing status.

If you havent paid enough in taxes you may end up owing taxes when you file your return. You dont have to pay Social Security and. One thing to keep in mind however is that SSDI and.

UNEMPLOYMENT INSURANCE BENEFITS STATE OF NEW JERSEY DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT Payment in Lieu of Notice When your employer continues to. The federal tax code counts. 24 and runs through April 18.

We are currently mailing ANCHOR benefit information mailers to.

Unemployment Tax Refund Question R Irs

Unemployment Taxes What To Know For The 2021 Tax Year

How Does The Federal Tax System Affect Low Income Households Tax Policy Center

Fafsa Treatment Of Unemployment Benefits In 2021 And Beyond

American Rescue Plan Tax Changes Child Tax Credit Tax Foundation

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

This Was The Average Tax Refund Last Filing Season Bankrate

Liz Weston No Need To File Amended Returns For Refund Of Taxed Unemployment Benefits Oregonlive Com

Eitc And Child Tax Credit Promote Work Reduce Poverty And Support Children S Development Research Finds Center On Budget And Policy Priorities

Tax Refund Delay What To Do And Who To Contact Smartasset

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

The Case For Forgiving Taxes On Pandemic Unemployment Aid

State Conformity To Cares Act American Rescue Plan Tax Foundation

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com

What To Know About Irs Unemployment Refunds

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Division Of Unemployment Insurance Faq Paying Federal Income Tax On Your Unemployment Insurance Benefits